WHAT IS CASH APP?

A money transfer service geared at mobile apps is called Cash App. Like with PayPal or Venmo, you may send and receive money instantly and easily. However, Cash App also has a few more features.

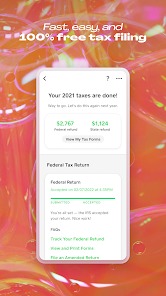

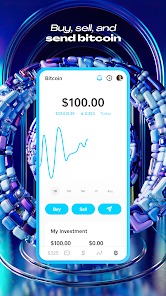

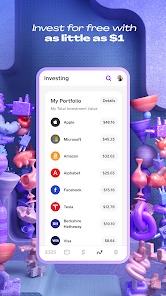

Cash App will provide you a bank account and a debit card that you can use at any ATM in addition to sending money. Through the program, you may even invest in stocks and bitcoin. While some of these services are free, some have a cost. However, there is a significant drawback: Your Cash App balance is not FDIC-insured. There is no assurance that you will get your money back if something goes wrong because that is just protection for your money.

Since 2013, there has been a Cash App. Square Inc., the parent business of Cash App, was referenced in the original name, which was Square Cash. Twitter CEO Jack Dorsey was a founding partner of Square Inc.

HOW TO USE CASH APP?

Send and Receive Money

Sending and receiving money is straightforward because to Cash App’s amazingly simple user interface. To send money, locate the recipient in the app using their name, phone number, or $Cashtag.

The recipient of the money will then get a text or email notice once you transfer the money. The receiver controls how quickly the transfer is processed.

You can send a request for payment to request money. You can send the request using your name, your cashtag, your email address, or your phone number. Once a payment has been made, the app will let you know, and you can then decide how quickly you want the money.

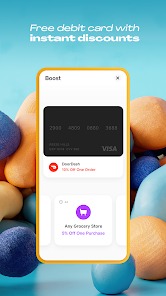

You have the choice to deposit money received through Cash App into either your bank account or the debit card that is linked to it. It takes up to 3 days for a deposit to appear in your account, even though the money is immediately deposited into your debit card. Both of these deposits, though, are gratuitous.

There is a $0.25 minimum fee and a 1.5 percent fee of the total amount if you would like an instant deposit made to your account.

Cash Limits

Within a 7-day window, you can send up to $250, and within a 30-day window, you can receive up to $1,000. You’ll need to further confirm your identification on the service in order to raise your sending and receiving limitations.

Cash App requires the last four digits of your Social Security number in addition to your full name, birthdate, and other personal information to properly authenticate your identification.

With Cash App, there is no minimum balance requirement for opening an account, and the account’s maximum amount is not made public. Sending and receiving money starts at $1. A Cash App balance is free, and there are no monthly or service fees.