WHAT IS VENMO USED FOR?

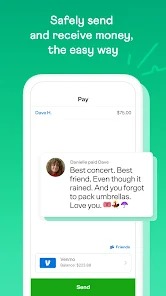

You may use the service to transfer funds to other Venmo users for nearly any purpose, such as covering your portion of the brunch tab or hiring a babysitter.

Downloading the Venmo app on a smartphone or creating an account on the Venmo website are both options available to anybody over the age of 18 with a bank account, debit card, or credit card. Once they link their bank information, any user may send or receive money from anyone in the US who has a Venmo account.

Venmo is another payment method that certain websites provide. Customers will see the “Pay with Venmo” button if they select PayPal as their form of payment throughout the checkout process.

Does Venmo, however, work for everyone? And while utilizing Venmo to send money to or receive money from pals, how can consumers ensure that their data is secure? Everything you need to know about “Venmoing” before creating an account is provided here.

HOW DOES VENMO WORK?

Users need to hit the “Pay or Request” button on the Venmo app and enter their friend’s username, phone number, or email address in the top box to pay or receive money. A QR code from the app can also be scanned by a buddy if they are close. From there, people may either ask them for money or send them money. The transaction is finished when you type a note stating what was purchased.

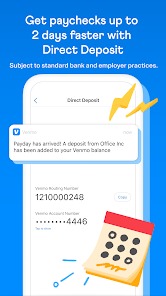

One of the user’s Venmo balance, a debit or credit card, or their bank account are the three places from which money may be sent using Venmo. To ensure that they always have money in the app, Venmo users may even ask for their whole paycheck—or just a piece of it—to be instantly transferred into the service.

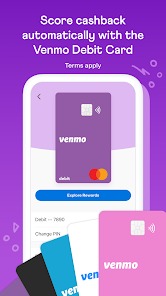

Client can ask for a Venmo debit card. The card may be used to make purchases everywhere Mastercard is accepted as well as to withdraw funds from a user’s Venmo balance. ATMs with the Mastercard, PULSE, or Cirrus brands allow withdrawals. Users must pay a charge if they withdraw money from a machine that isn’t part of the MoneyPass network.

The Venmo debit card has restrictions that affect how much cash you may access. If you want to withdraw money from an ATM, the maximum amount you may take out is $400 per day, with a strict withdrawal limit of your Venmo account balance.

Additionally, the business just introduced a credit card using the Venmo logo. It has a QR code stamped on it so that when someone scans it with their phone, your Venmo profile appears. Similar to a typical Venmo transaction, they can then send you money or make a payment request. Additionally, for extra security while shopping online, it provides a so-called virtual card number that is different from the one that is imprinted on the card.