WHAT IS KOHO?

A free spending and savings account called KOHO is available to help you organize your personal money.

It resembles a spending account somewhat while offering credit card benefits. Consider KOHO as a set of tools that will enable you to achieve your objectives more quickly and spend your money on things you enjoy rather than undesirable things like credit card interest or unexpected costs.

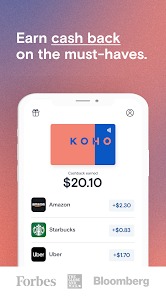

Your KOHO account functions similarly to a spending account in that you can deposit funds there and utilize them anyway you see appropriate (we like munchies and trips!). In addition, you may use your KOHO reloadable prepaid credit card anyplace Mastercard® is accepted, making us similar to a credit card in that we provide cash back and other benefits.

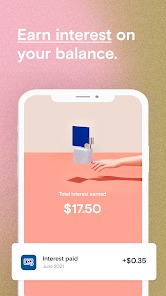

The main distinction is that, unlike a regular credit card, the monies on your card are already yours; there is no interest to pay and they are, well, all yours. Additionally, the typical KOHO user actually decreases their total expenditure and saves 7% of whatever money they load into their account, unlike pretty much everyone else with only a bank-issued credit card.

The bottom line is that KOHO makes managing your spending and saving habits simpler and, dare we say, even more enjoyable.

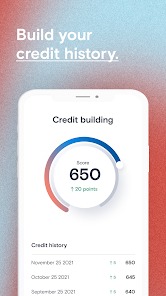

HOW DOES KOHO WORK?

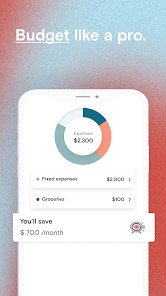

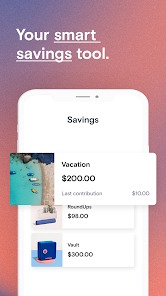

It’s rather easy to do; either make an e-Transfer from your current bank account or have your employer direct deposit your paycheque to add money to your KOHO account (we call this direct deposit). Then, exactly like with a regular debit or credit card, you may use your KOHO card to make transactions offline or online. Finally, you may use your KOHO app to analyze your spending and saving patterns and develop simple savings goals.

Remember, you may use your KOHO card for everything Mastercard is accepted for, including paying for a gym subscription or testing out that trendy new fusion tapas joint. Because we operate on the Mastercard network and the card is a reloadable prepaid Mastercard, businesses will regard your card purchase exactly like any other credit card transaction.

With the help of our really outstanding app, you can easily save some money by setting up RoundUps on your purchases, seeing your cash back increase, and seeing how much you’re spending at a glance.

In order to make it simpler to take a weeklong vacation to Lisbon, prepare for the release of that trending new pair of sneakers, or do anything else that makes you joyful, you can also put up clear savings goals.