WHAT IS BEFOREPAY?

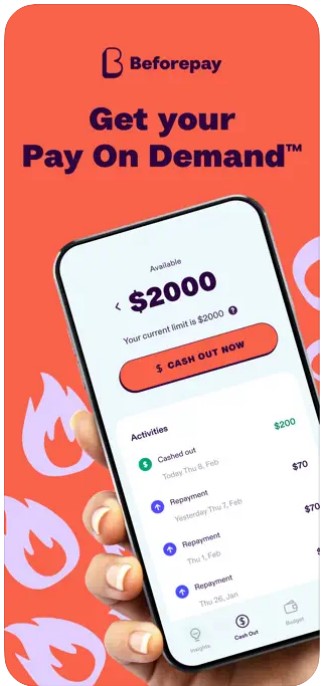

You can get credit through the beforepay app based on a percentage of your earnings before payday. After that, you have a further four weeks to pay back the loan plus a 5% transaction charge. Beforepay gives you the money as a lump sum cash advance that goes straight into your bank account, unlike other purchase now pay later models like Afterpay and Zip Pay that allow you borrow money for particular transactions.

HOW TO USE BEFOREPAY?

You must download the Beforepay app on your smartphone in order to use it, and you may sign up for an account with your Facebook or email credentials. According to Beforepay, more personal information may be requested, such as your name, age range, cellphone number, and the state or region you call home. Then, if you want to borrow money via the app’s “cash out” option, you may link your bank account and employment information.

You must fulfill specific eligibility requirements, which Beforepay specifies on its website, in order to utilize this “cash out” service, it warns. A consistent wage of at least $300 after taxes per week must be paid to you (weekly, biweekly, or monthly), among other requirements. Before you can utilize the function, it can also require you to send over documentation to prove your identity. Self-employed individuals and business owners, as well as those who work from home or get most of their money from Centrelink, are not eligible for Beforepay, the company claims.

Although Beforepay claims it does not do credit checks or have an impact on your credit score, it does analyze your income and outgoings as part of its evaluation process to make sure you can afford to make payments.

HOW DOES BEFOREPAY WORK?

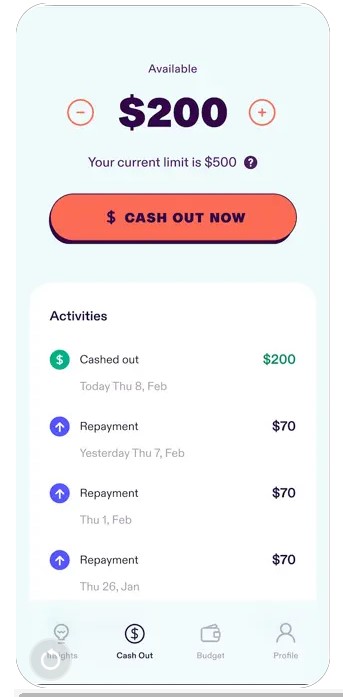

If you satisfy Beforepay’s eligibility requirements and opt to borrow money from it, Beforepay will loan you the sum you select and are eligible for, which may range from $100 to $1,000 every pay cycle, and give you four weeks to pay it back. Beforepay claims that the app’s three phases are how it operates on its website:

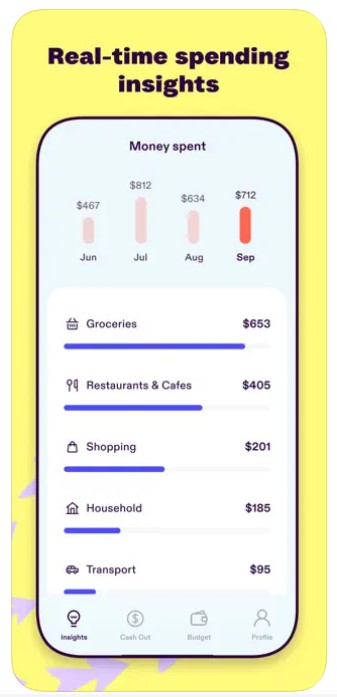

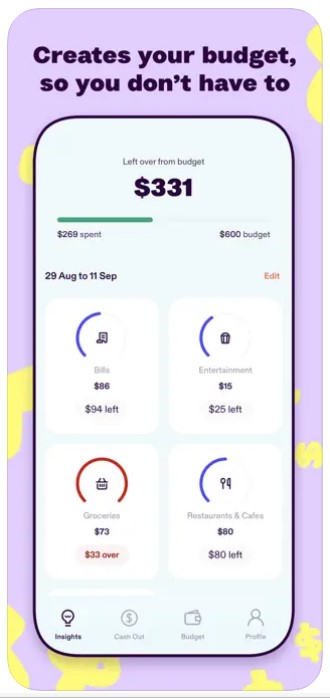

- Link the Beforepay app to your bank account so that it can keep track of your pay schedule and expenditure. This will enable the Beforepay app to track your paycheck.

- Decide your amount: Take out between $100 and $1,000 every pay period to have it appear in your bank account as a loan.

- Return: You have up to four weeks to return the borrowed funds in addition to a set transaction charge of 5%. The complete sum can be paid back when you get paid, or you can choose to pay it back in installments over a maximum of four weeks.